The decision to expand abroad.

The decision has been made to expand internationally. The reasons for this can be diverse. Rarely is a specialist for the target market consulted up to this point; the entry is decided internally and is set. Please also take a look at our Market Entry Framework. Often, the company is not only successful but also a price leader or technology leader in its field. Help is often sought only in the background for language barriers, e.g., in China or Brazil. The cultural differences and challenges are almost always underestimated. Due to success in the home market, one thing is rarely considered: That the expansion could fail.

What Can Be Learned from the Decision Tree in the Oil Industry. To Drill or Not?

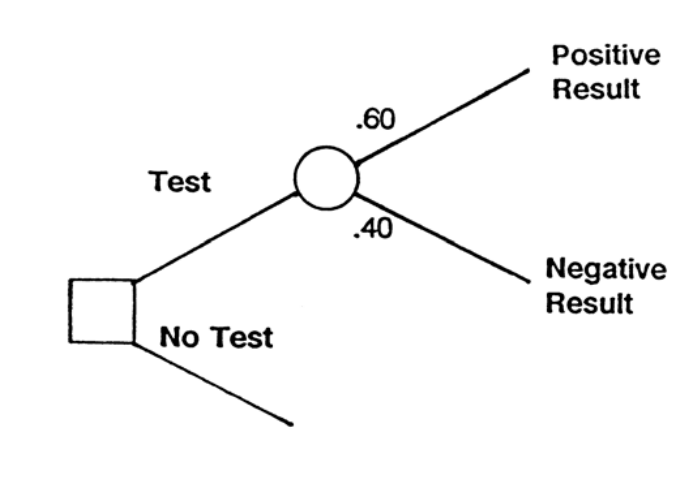

The insights from the well-known book “Decisions Under Uncertainty: Drilling Decisions By Oil and Gas Operators” are taught in many MBA courses. Decision trees and Expected Monetary Value (EMV) are powerful tools in decision analysis that have their roots in the oil industry and have since found wide application in finance and other fields. These concepts were developed to help decision-makers navigate complex choices in uncertain environments. Decision trees emerged in the 1960s as a graphical method for representing and analyzing sequential decision-making under uncertainty. They provide a structured approach to breaking down complex problems into a series of smaller, more manageable decisions.

By visually mapping out different scenarios, their probabilities, and potential outcomes, decision trees allow for a clearer understanding of the available options and their possible consequences. Expected Monetary Value (EMV) is a key concept used in conjunction with decision trees. It provides a way to quantify and compare different options by calculating the average outcome of a decision, taking into account the probabilities of various scenarios. The EMV is computed by multiplying each possible outcome by its probability and then summing these products.

The oil industry played a pivotal role in the development and refinement of decision tree analysis and EMV concepts. In the 1960s, oil companies faced high-stakes decisions about where to conduct exploratory drilling. They needed a systematic method to evaluate geological uncertainties and potential returns. Decision trees allowed them to map out drilling scenarios and calculate EMVs to compare options, which helped optimize exploration strategies and capital allocation.

The principles developed in the oil industry were soon recognized for their broader applicability and adopted in the financial sector. Financial experts recognized the value of using decision trees and EMV for various applications, including investment decisions, risk management, portfolio optimization, and option pricing. The finance industry built upon the foundational work from oil exploration, incorporating more complex probability distributions, developing sophisticated software tools for analysis, and integrating these concepts with other financial models and theories.

In the financial world, decision trees and EMV have become invaluable tools for structuring problems, quantifying uncertainties, and making data-driven decisions. They are used to evaluating projects, analyze potential outcomes of different strategies, optimize asset allocation decisions, and model the value of financial options. This evolution from oil exploration to finance demonstrates how powerful analytical tools can be adapted and refined across industries to address similar challenges in decision-making under uncertainty.

Today, the principles of decision trees and EMV are applied in various fields beyond oil and finance, including healthcare, technology, and public policy. Their enduring relevance speaks to the universal need for structured approaches to decision-making in complex, uncertain environments. As data analysis and computational capabilities continue to advance, these tools are likely to evolve further, maintaining their importance in helping individuals and organizations make more informed and effective decisions.

Chances of Success

The chances of success for a successful market entry are much lower than most companies assume. Don’t forget, even the billion-dollar corporation Walmart failed with its market entry in Germany. And Walmart certainly didn’t fail due to lack of financial power or lack of knowledge of how to do business. The owner of a German medium-sized chemical company that was close to sinking a double-digit million amount in the USA once said that 9 out of 10 market entry attempts in the USA would fail. One can discuss this number for a long time. But the chances of success are certainly not above 50%. And success prospects of at most 50% are not particularly good. You should be clear about three things: 1. The odds are against you. 2. You must do everything that increases the chances of success. And 3. The market entry could fail.

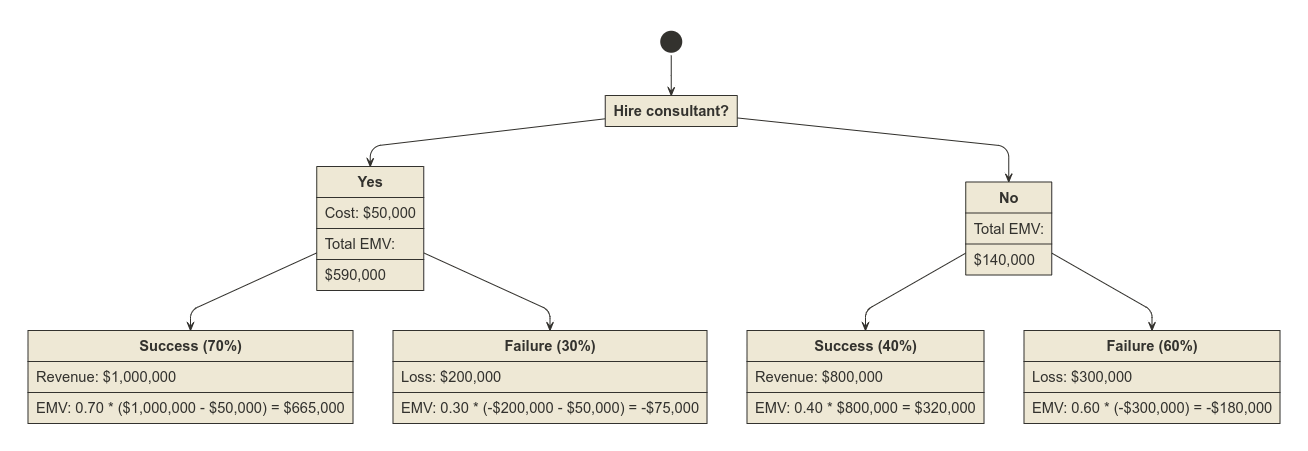

This decision tree uses the concept of Expected Monetary Value (EMV) to make a data-driven decision about whether to hire a consultant for entering a foreign market. Let’s break down the analysis:

Hiring a Consultant:

- The probability of success is higher (70%) due to the consultant’s expertise.

- The potential revenue is higher ($1,000,000) as the consultant may help identify better opportunities.

- The costs of failure are lower ($200,000) as the consultant can help mitigate risks.

- The consultant’s fee is assumed to be $50,000.

Not Hiring a Consultant:

- The probability of success is lower (40%) without expert guidance.

- The potential revenue is lower ($800,000) due to potentially missed opportunities.

- The costs of failure are higher ($300,000) due to increased risks.

- The EMV calculations show that hiring a consultant has a significantly higher expected value ($590,000) compared to not hiring one ($140,000). This suggests that despite the additional cost for the consultant, the increased probability of success and potentially higher revenues make this option more attractive.

This decision tree analysis provides a clear framework for decision-making and takes into account both the costs and potential benefits of hiring a consultant. It shows that the relatively low cost of the consultant is outweighed by the significantly increased chances of success and potential revenues. Keep in mind that while this analysis provides valuable insights, it should be combined with other factors such as company strategy, risk tolerance, and qualitative considerations before a final decision is made.

We provide a sample analysis in UML diagram format instead of the usual event fork and activity fork conventions.

The numbers are just examples; you can now play through this at any time with your own probabilities.

You want to expand in Europe, Germany, China, Brazil or India? Looking for long term partners? Talk to us.