We have observed that many companies fail when entering a foreign market and suggest a pre market entry framework.

For a foreign company that wants to enter the US market, this would look like this:

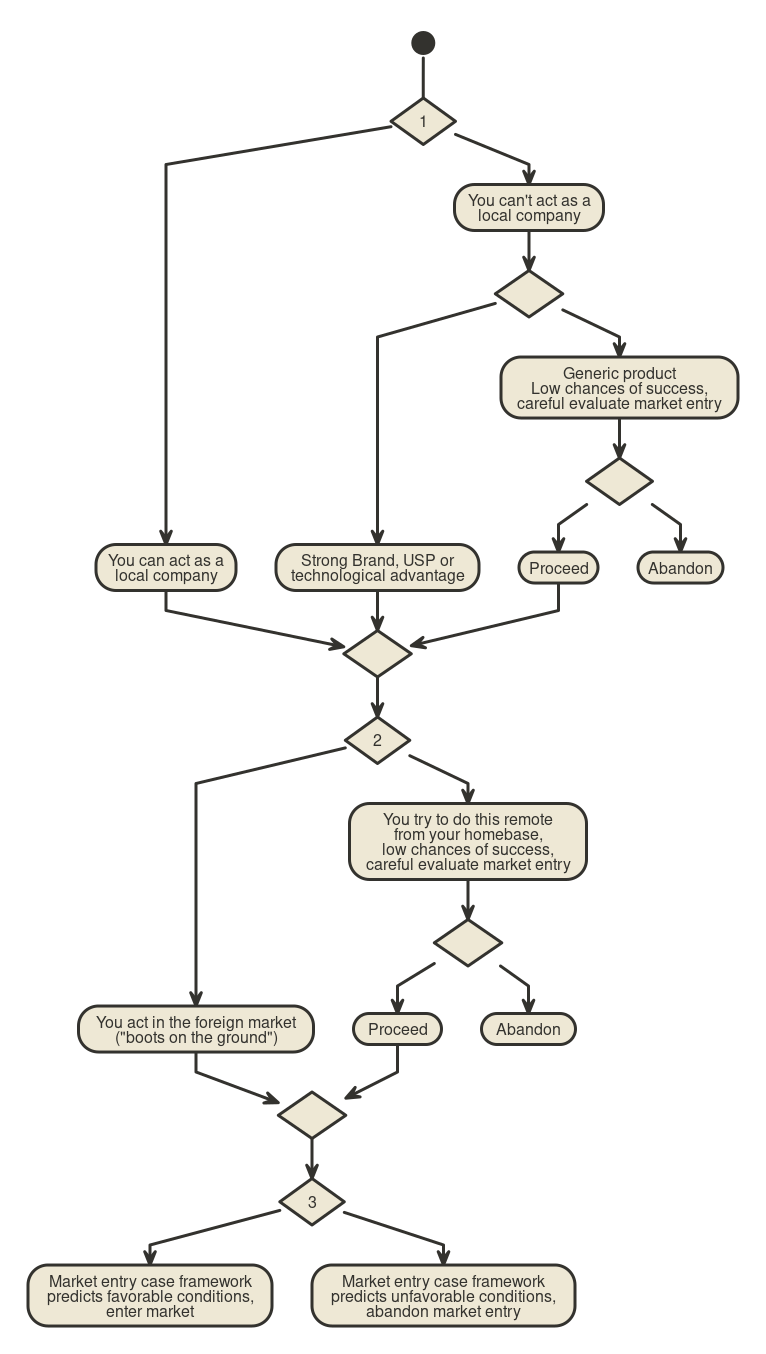

While this may sound trivial, if a company fails in a foreign market, it failed by at least one of the three steps involved. Sometimes it fails by more then one.

Let’s have a look at step 1. We are not talking about setting up a local entry, we assume this as a given. GMEX consulting has experience in many different markets and is able to explain the differences and leverage this knowledge to reduce risk when entering a market. Let’s assume a different example, a company wants to enter the Chinese market. The Pre Market Entry would look like this:

Is this even possible? Of cause you can set up a local entity in the Chinese market. But to be successful in the Chinese market, you need to have at least one of these two things:

- Strong Brand

- Unique selling point (USP), strong IP, major, possibly unique, technological advantage

Why is that? It has the same reason why you should never buy a Chinese supplier. We know companies, that decided to buy local suppliers in China to have more control in their supply chain. The idea is that their orders can always be processed with a higher priority. This rarely ends well. Sure, the Chinese supplier is profitable. But is the company even allowed to produce this product at their current location? Likely not. Nobody cares but if a foreign company buys the Chinese supplier, this will sooner or later start to become a problem. Are they paying all their employees in full? Or is only a part of the salary paid and the other part under the table? Nobody cares but soon somebody will care if a Western company owns this company. Do they have all their permits, do they obey all environmental regulations etc.? Probably not, but soon this will be a point of interest. Likely the company will make losses within a year or two under Western management.

This brings us to point one of the pre-market entry consulting framework. Is it even possible to act like a local company? In the Chinese market it is not. This is the reason why you can never compete with a generic product in the Chinese market against Chinese companies. Bottom line: There are markets where you can not act like a local company.

Case study example A: A European B2B supplier in the automotive industry tries to enter the Chinese market. It is a market leader in its home market with a product that offers slightly better quality but is 20% more expensive then the competition. They open a local company with European employees in China but are not able to get any relevant customers. After 10 years they do a re-start of the project. It will fail again. There is no market for their product in China. Open a local production or buying a local competitor won’t be a successful strategy either in their case. They have at least lost at least a seven figure sum in the Chinese market up to now.

In many markets you just can act like a local company. But this has to be evaluated before and deep knowledge of the target market, culture and political situation is necessary.

Step two. Act in the local market. This is a mistake that American companies rarely do if they expand abroad, American companies nearly always act with boots on the ground in the target market. Especially many European SME take a different approach, when expanding in the US. They open a US company, a US LLC or US Inc can be opened with a few mouse clicks, adjust their website for the US market but try to do business development from their home country. The employee, lets call him business development manager USA, will sit as his desk and tries to remotely manage this and may fly from time to time to the US. This approach will either fail or will show only a fraction of results that could be achieved with a real presence in the US.

Case study B: A European based SME in the biotech B2B industry tries to expand into the US. Instead of hiring people in the US, they hire employees in Europe and “engage” the US market from Europe. Since they don’t know the US market well, they are not aware of the most important B2B publication outlets in the target industry. To our knowledge this magazines are not available in Europe. If you don’t advertise there, you just don’t exist. Just by not knowing the most important advertisement space, he achieved only 10% of what could have been achieved. Furthermore, most of his target clients are on the West coast. What is the overlap between business ours between the time zones? Who picks up the phone?

To be successful with a foreign market entry you will need a local presence with boots on the ground. Trying to do this remotely will likely fail or produce subpar results. A mistake rarely done by US companies, but often done by European companies.

Step three. For the local consumer. The regular market entry consulting framework can be used to help evaluate if a market entry abroad is advised.

Case Study C: Walmart tried to enter the German market many years ago and failed big time. How can a major player, a highly competitive company, a company with deep pockets like Walmart fail? It has been the topic of many publications and has been analysed by many MBA programs. For example see “Why Walmart Fails in Germany? An Analysis in the Perspective of

Organizational Behaviour” by Sahibzada Hamza and Ismail Nizam International Journal of Accounting & Business Management

Vol. 4 (No.2), November, 2016 ISSN: 2289-4519 DOI: 10.24924/ijabm/2016.11/v4.iss2/206.215

The clear point of failure is up for debate and many studies point out the cultural problems in management. The company was run too much like a US company with some cultural clashes. This would point to Step 1 – act as a local company – as the point of failure. While it was not helpful, we don’t believe Walmart failed because of this. We believe they failed in step 3. They did not serve the target consumer, did not take into consideration local shopping habits and entered a extremely competitive market while have no real advantage. There is no basis for Schadenfreude here. It should serve as a warning that even the strongest companies can fail when expanding abroad. Local expertise is obligatory.

In another post we will analyse companies that chose a different, successful strategy, when expanding abroad. Like Aldi to the US and to China or Costco to France.

Below you see a step by step market entry diagram, slightly based on a uml diagram:

Talk to us. We help you expand successfully abroad while reducing risks. We help you in your home base and in your target country.