Source: Xinhua

UBS, Goldman Sachs, and Nomura have adjusted their forecasts for China’s economic growth in 2024 following a series of stimulus measures implemented since late September, predicting that Beijing will achieve its target of “around 5 percent.”

International financial institutions have increased their projections for gross domestic product (GDP) growth in 2024—an otherwise challenging year marked by sluggish retail sales and declining property prices—with estimates from UBS, Moody’s Analytics, Goldman Sachs, and Nomura now reaching as high as 4.95 percent.

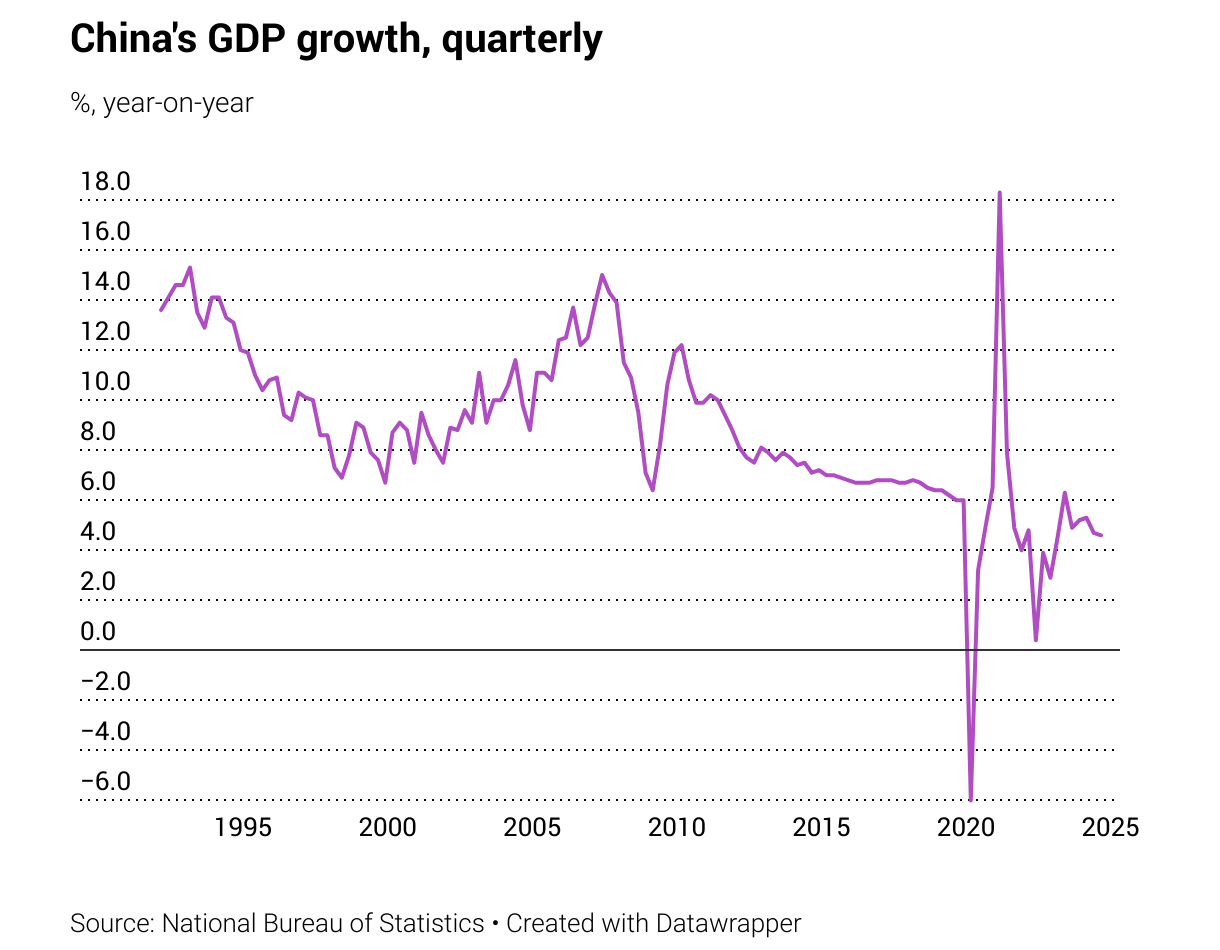

Last week, China reported a 4.6 percent increase in GDP for the third quarter compared to the previous year, marking the lowest quarterly growth since mid-2023. This brought the growth rate for the first three quarters of the year to 4.8 percent.

Swiss investment bank UBS raised its forecast for the world’s second-largest economy from 4.6 percent to 4.8 percent on Monday, citing stronger-than-expected third-quarter GDP growth and a recently announced policy push, according to a research note from its China economist, Wang Tao.

Chinese officials began implementing monetary stimulus policies at the end of last month, including significant cuts to mortgage and policy rates aimed at bolstering the national economy and achieving the 2024 GDP target. On Monday, the People’s Bank of China reduced the benchmark five-year loan prime rate from 3.85 percent to 3.6 percent, while also lowering the one-year lending rate from 3.35 percent to 3.1 percent.

Moody’s Analytics also raised its 2024 forecast on Monday from 4.8 percent to 4.95 percent, with expectations lifted by the recent stimulus measures despite ongoing economic “weakness” in the third quarter.

“To be clear, the latest support measures are welcome,” said Moody’s Analytics economist Harry Murphy Cruise last week. “They are likely to propel the economy toward its ‘around 5 percent’ target for the year.”

Goldman Sachs had already revised its growth estimate for China from 4.7 percent to 4.9 percent last week, while Japanese investment bank Nomura announced on Monday that it had increased its forecast for 2024 from 4.6 percent to 4.7 percent.

In contrast, Standard Chartered chose not to lower its prediction of 4.8 percent growth for this year in light of Beijing’s stimulus measures. A spokesman for HSBC also confirmed on Monday that the bank is maintaining its previous forecast of 4.9 percent.

At the end of September, Nomura noted that despite China’s “bazooka” of stimulus measures, “Beijing still needs to implement well-thought-out policies to address many deep-rooted issues, particularly concerning stabilization in the property sector.”

Forecasts for 2025 are generally lower than this year’s estimates, with Goldman Sachs predicting a growth rate of 4.7 percent next year, slightly above UBS’s expectation of 4.5 percent. Moody’s Analytics anticipates that China’s GDP will grow by 4.75 percent in 2025.

The Asian Development Bank expects a growth rate of 4.5 percent in 2025, down from this year’s estimate of 4.8 percent. Analysts pointed out that potential new tariffs on Chinese exports to the United States could emerge if former President Donald Trump wins next month’s election.

“In the event of a sharp increase in U.S. tariffs, we would expect growth to fall below 4 percent even with more substantial policy stimulus,” UBS warned on Monday.

However, financial services firm ING has raised its economic growth forecast for 2025 from 4.6 percent to 4.8 percent due to anticipated impacts from fiscal stimulus next year, according to its Greater China economist Lynn Song.

ING also predicted a growth rate of 4.8 percent for this year.

Can you afford not to be present in China? Talk to us, we’ll help you succeed in China.